Recherche zu Polygon (MATIC)

Executive Summary

Polygon is a major Ethereum scaling solution. Polygon’s main product is a proof- of-stake (PoS) commit-chain, also known as the Polygon PoS Chain, that offers high throughput, low transaction fees, and records checkpoints of the chain’s state to the Ethereum mainnet.

Polygon exhibits a proven track record of attracting users, developers, and capital. Polygon connects Ethereum-compatible blockchains and is developing rollup technologies, including zero-knowledge scaling solutions. Polygon seeks to become the “Value Layer of the Internet”.

Performance

Marktkapitalisierung

USD

Verwässerte Kap.

USD

Volumen

USD

Sharpe Ratio

Excerpt from the Report

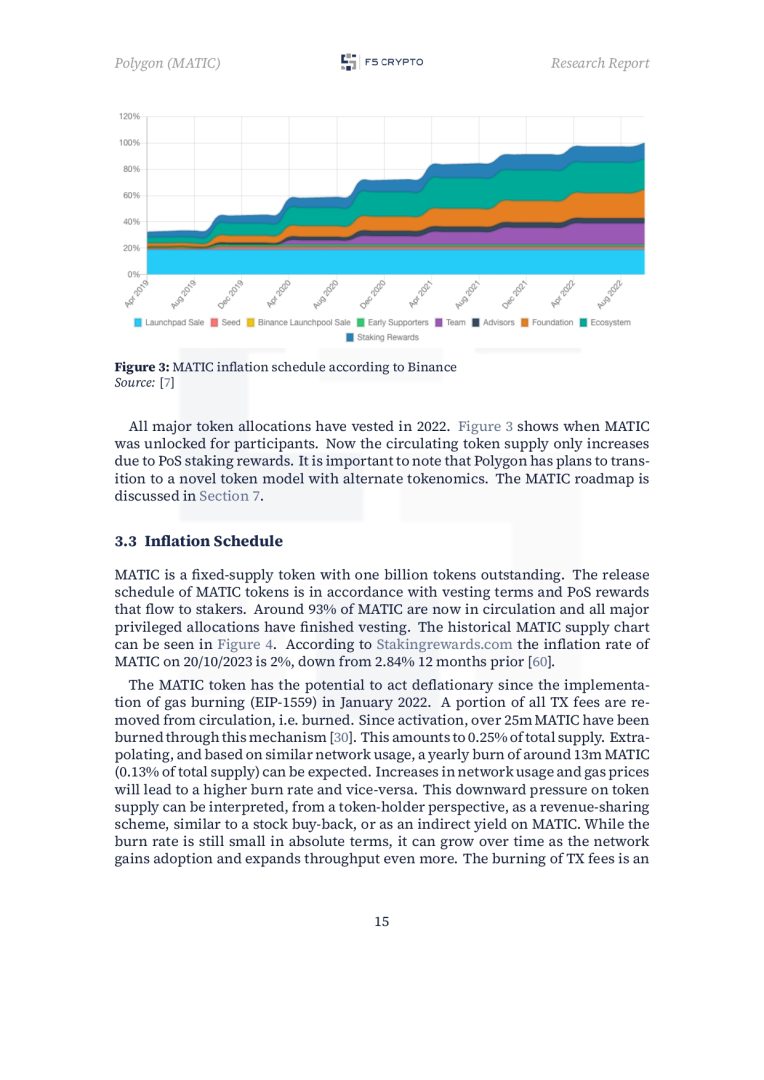

Inflation Schedule

MATIC is a fixed-supply token with one billion tokens outstanding. The release schedule of MATIC tokens is in accordance with vesting terms and PoS rewards that flow to stakers. Around 93% of MATIC are now in circulation and all major privileged allocations have finished vesting. The historical MATIC supply chart can be seen in Figure 4. According to Stakingrewards.com the inflation rate of MATIC on 20/10/2023 is 2%, down from 2.84% 12 months prior.

The MATIC token has the potential to act deflationary since the implementation of gas burning (EIP-1559) in January 2022. A portion of all TX fees are re- moved from circulation, i.e. burned. Since activation, over 25m MATIC have been burned through this mechanism. This amounts to 0.25% of total supply. Extrapolating, and based on similar network usage, a yearly burn of around 13m MATIC (0.13% of total supply) can be expected. Increases in network usage and gas prices will lead to a higher burn rate and vice-versa. This downward pressure on token supply can be interpreted, from a token-holder perspective, as a revenue-sharing scheme, similar to a stock buy-back, or as an indirect yield on MATIC. While the burn rate is still small in absolute terms, it can grow over time as the network gains adoption and expands throughput even more. The burning of TX fees is an economically sound mechanism that returns value to the token holder with in- creased network adoption.

F5 Crypto’s Assessment of the Tokenomics of MATIC

The tokenomics of MATIC do not raise any particular concers from an investment standpoint. The token is expected to reflect the approximate value of the network through its three primary use cases. With almost all tokens in circulation, MATIC is a token whose liquid supply will not increase substantially or suddenly. New MATIC tokens enter circulation via staking rewards while tokens are removed via burning of TX fees. The long-term net issuance rate will be determined by the dynamics of PoS rewards, usually steady and predictable, and the gas-fee level, which is volatile and unpredictable. Ultimately, a moderate increase in the token supply can be partially or entirely off-set by network adoption and a healthy fee market. This is very positive for MATIC’s long term ability to return value to the token holder.

Unser Recherche-Team

- Krypto seit 2012

- Professor mit 30 Jahren

- Blockchain-Vorlesungen

- Entwickler Krypto-Index

- Krypto seit 2015

- Krypto-Unternehmer

- Akad. Krypto-These

- Fundamentalanalysen

Das Rercherche-Team von F5 Crypto ist einzigartig in Deutschland. Durch seine interdisziplinäre Expertise, kontinuierliche Forschungsarbeit und exzellente Leitung wird Recherche-Qualität auf institutionellem Niveau sichergestellt. Unterstützt wird das Recherche-Team durch die Fondsmanager des hauseigenen BaFin-registrierten Krypto-Fonds “F5 Crypto Fonds 1“.