A Short Token Taxonomy — and Which Tokens Our F5 Crypto Fund Invests In

CoinMarketCap lists more than 10,000 traded crypto assets. These assets differ fundamentally. In this article, we outline the key types of investable crypto assets and provide an assessment of how our F5 Crypto Fund approaches them.

Bitcoin and Bitcoins

Bitcoin was the first public blockchain. To incentivize people to participate in the mining process, Bitcoin issues crypto coins — called bitcoins. Once created, bitcoins generate no cash flow in the form of dividends or fees. However, they provide exceptionally strong property righta: only the owner who controls the private keys can move the corresponding bitcoins. No company and no government can move, freeze, or seize bitcoins without the private key.

Because of this property, Bitcoin is the ultimate store of value. Since its launch in 2009, it has continually reached new price highs. The Bitcoin–gold equivalence in market cap (gold also generates no cash flow and serves almost exclusively as a store of value) is currently around €830,000 per bitcoin.

🇩🇪 Bitcoin ist digitales Gold – F5 Crypto Blog Post from 2018

If Bitcoin continues its triumphal rise, it will, as a digital and globally accessible store of value, far surpass gold’s market capitalization.

Ethereum and L1 Tokens

Ethereum’s ether offers property rights almost as strong as Bitcoin’s. However, we assume that a leading global store-of-value favorite will capture the majority of the store-of-value market, just as gold has so far. Up to now, the market has chosen Bitcoin as the primary store of value among all cryptocurrencies. The price of ether, therefore, rests only partly on the store-of-value narrative; it is driven more by (expected future) cash flows.

Ethereum processes transactions of many kinds, such as stablecoin transfers, token loans, and token swaps. Each of these transactions pays a small fee in ether to the network. Part of these network fees are distributed to ether holders (stakers). This creates a straightforward valuation model: ether generates cash flow in ether, while the transaction market determines its price.*

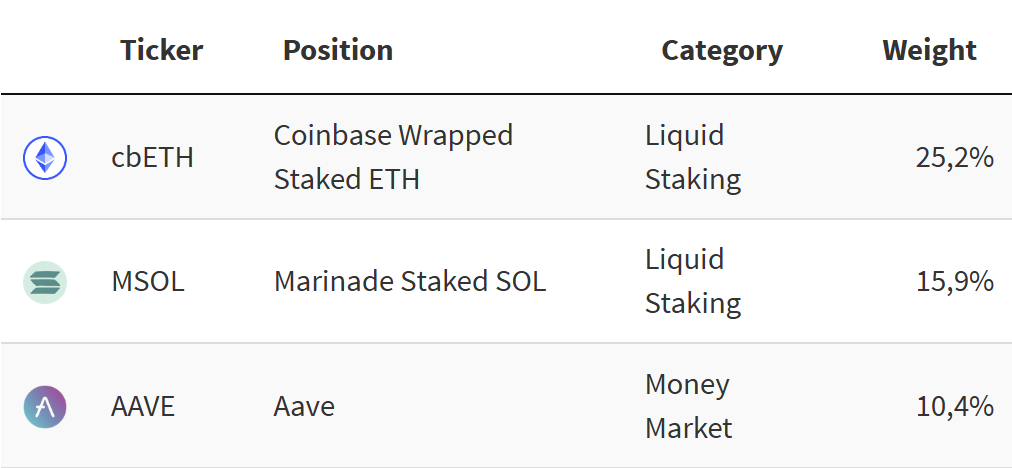

Other layer-1s, such as Solana with its native token SOL, operate on the same principle. Solana processes a very high volume of transactions, and part of the fees are distributed to Solana stakers.

Our F5 Crypto Fund participates in the staking yields (“cash flows”) of ether and Solana through corresponding liquid staking tokens held in the fund’s portfolio.

L2 Tokens

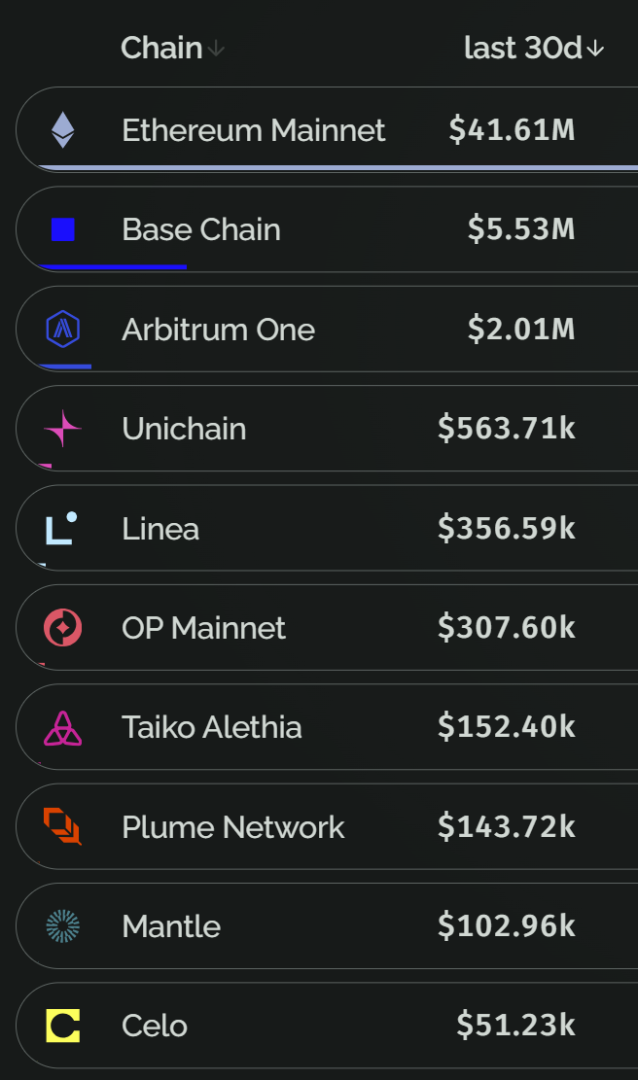

For most users, a layer-2 blockchain is hardly distinguishable from its host blockchain, the layer-1. It provides access to the functionality and security of the L1, but operates independently and is generally cheaper, faster, and often specialized in a specific application area. For example, Celo focuses on stablecoin transfers. Most L2s issue their own separate token, such as Arbitrum, an L2 on Ethereum, which issues the ARB token.

Compared to L1 tokens, L2 tokens have even less claim to be a store of value. They are too numerous and provide weaker property right guarantees. Their valuation therefore relies almost entirely on activity and transaction fees.

In September 2025, the website growthepie reported that Arbitrum, one of the leading L2s, generated around USD 2 million in user fees over the past 30 days. At the same time, the L2 paid “rent” to its L1, Ethereum, amounting to about USD 30,000. The business model of layer-2s in this case is highly profitable.

So far, ARB tokens are not directly tied to these profits. The gains flow to the sequencer, which in theory is controlled by ARB token holders. It can be expected that, after the current focus on growth, a direct participation of ARB tokens in revenues generated will move to the forefront. Our F5 Crypto Fund is closely monitoring the layer-2 scene but does not hold any layer-2 tokens at this time.

Businesses on the Blockchain

A great deal of economic activity takes place on public blockchains. Since its inception, Bitcoin has processed around €8 trillion in transaction volume. Every month, about 120 million stablecoin transactions are carried out, with a total value of roughly €800 billion. Each day, the Uniswap protocol handles between €1 and €2 billion in trading volume.

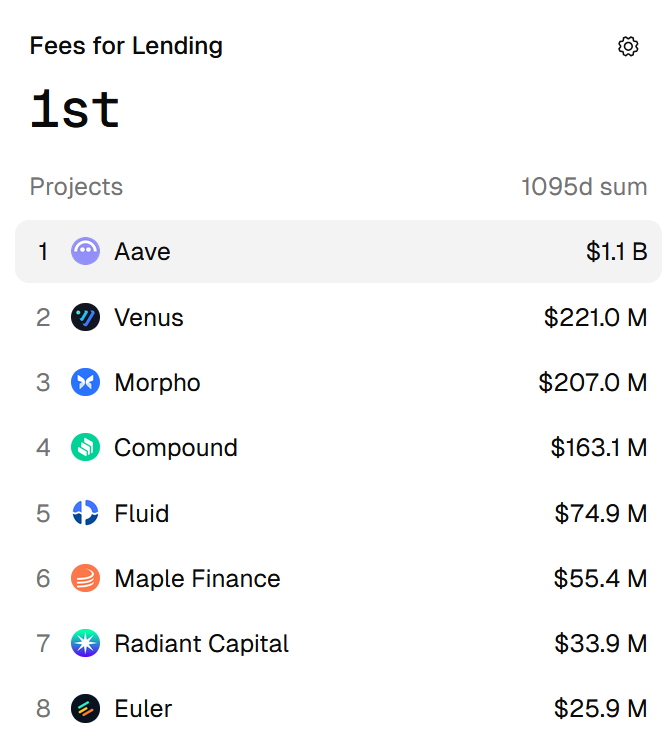

Blockchain protocols that offer stablecoins, trading, or lending services collect fees for doing so. These fees are available to the protocol, much like to a regular company, to fund growth or to pay out dividends to the protocol’s token holders.

For example, the AAVE protocol offers the functionality of lending against crypto assets. A holder can deposit bitcoin worth, say, €10,000 into the protocol in order to take out a loan of, for instance, €5,000. This gives the user additional liquidity. To reclaim the deposited bitcoin, the user must repay the €5,000 loan plus accrued interest. This interest is the protocol’s revenue. The advantage for the user: the process requires no bank account, no loan approval processing time, and carries no third-party risk as the protocol operates independently on the blockchain.

In the crypto market, these blockchain service providers are where the action is. Successful protocols on public blockchains generate massive cash flows. They often enjoy a moat through liquidity and have virtually no expenses.** These protocols offer enormous growth potential and, in some cases, are very attractively valued. Our F5 Crypto Fund focuses on blockchain protocols with strong expected future cash flows, as these carry the promise of extreme returns.

Collectibles

Blockchain tokens are known for temporary price excesses. These occur particularly often with collectibles. Well-known examples include memecoins like DOGE and PEPE; NFTs such as Etherrocks and Bored Apes; and virtual land like MANA or SAND.

The value of collectibles fluctuates with market sentiment. Predicting market sentiment is difficult. Humans have always collected things and formed social groups around various themes. Online, such social groups can grow very large. With a corresponding memecoin or NFT collection serving as group identity — much like a football scarf — crypto achieves product-market fit in this area.

For our F5 Crypto Fund, collectibles are almost never of interest. However, in market environments where collectibles present an attractive risk–reward profile, it is possible that the fund may temporarily participate in the performance of a collectible.

Crypto Assets and Our F5 Crypto Fund

Bitcoin is a revolutionary store of value. Likely the best the world has ever had. Ether and other smart contract platform tokens derive their value from the economies their blockchains enable. Blockchain business models provide (financial) services that, like any other business, generate revenue. Their ownership structure is based on tokens rather than shares. Collectibles are limited digital objects without a direct link to a service.

Our F5 Crypto Fund focuses on blockchain business models that are already profitable or have the potential to become so. It invests in their tokens, which indirectly participate in these cash flows. In addition, the fund invests in L1 tokens of growing ecosystems. The fund turns to Bitcoin only in riskier market situations and for liquidity management. Collectibles are only rarely and briefly included, in special market environments with promising opportunities.

*When the price of ether falls, transactions become cheaper, leading to more transactions being executed until the transaction limit (gas limit) is reached. From that point on, transactions compete for inclusion, and the cost of executing them rises. This, in turn, increases the yield for stakers in the reference currency, and thereby the price of ether in the reference currency. The number of transactions and transaction costs always reach an equilibrium. This equilibrium determines the price of ether. It is proportional to the economic output behind all processable transactions. In short: the more activity takes place on an L1 blockchain with transaction fees and staking, the higher the fair price.

** Blockchain protocols are software. Software has no offices or employees. Some protocols pay grants or salaries to developers or protocol stewards, while others operate entirely on a voluntary basis.