Your best performing investment

Is a Crypto Investment the right choice for you?

- Are you striving for investments with outstanding returns?

- Do you want to invest in a managed, safe and well regulated product?

- Do you prefer to have professional crypto fund managers make smart investment decisions for you instead of navigating the crypto investment universe yourself?

Choose the Right Partner

- Invest in the highest returning crypto assets: the winners of tomorrow.

- Invest simply and safely in our crypto fund Made in Germany.

- Investment decisions are made by our successful and long-standing crypto experts. Large institutional investors as well as the fund managers personally are invested in the same fund. Now, you can join them!

Achieve Exceptional Returns

The minimum investment amount is EUR 50,000

Your Benefits

- Turbo-charge your investments by adding in the highest returning asset class: Crypto.

- Invest alongside experienced experts who invest professionally.

- Invest safely: F5 Crypto is licensed by strict German regulator BaFin since 2021.

Benefit from the Crypto Investment Trend

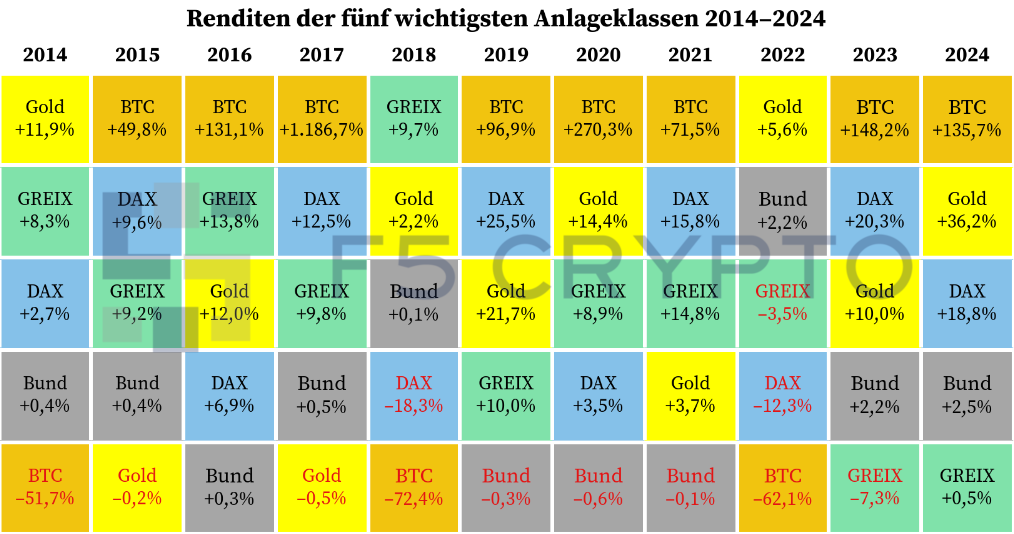

In the last 11 years, Bitcoin has been the highest-returning investment 8 times. Way ahead of the German stock market index DAX, gold, real estate, and of course, fixed income like German government bonds.

About our F5 Crypto Fund

- Available since 2021 – The most experienced liquid crypto fund on the German market.

- Safe and regulated by German BaFin as a special AIF according to § 282 KAGB.

- The broadly diversified crypto portfolio goes beyond major assets such as Bitcoin, Ethereum, and Solana and adds highly profitable crypto business tokens like Maker and Aave. All investment positions are selected by our experts based on fundamental analyses.

Investors are confident in F5 Crypto

For me, the F5 Crypto Fund stands for security paired with in-depth crypto expertise made in Germany. As an entrepreneur and investor from the very beginning, F5 Crypto is part of my crypto allocation. I appreciate the direct line to the founders and fund managers, who can always help me with well-founded explanations when I have crypto questions.

We chose F5 Crypto because a young, innovative team has a proven track record of achieving very good results. The transparency and constant willingness to provide information gives us the feeling that we are in the right place at the right time.

We have been managing the F5 Crypto Fund with conviction and pioneering work since 2021. We let deeds speak for themselves and are invested in our fund with a mid-seven-figure amount.

Thanks to the cooperation with F5 Crypto, we can offer our customers even more comprehensive access to digital assets – with the highest security standards and maximum transparency.

F5 Crypto has thus done a lot of pioneering work and, with the new crypto fund, is creating for the first time a promising opportunity for institutional investors to invest in crypto assets in a broadly diversified manner and with monthly redemption options.

Our motto is that we invest in the best technologies and founders. F5 Crypto fulfills these criteria. We have been invested in the fund since 2022.

About Us

Together, we combine many years of experience in technology, finance and crypto investments.

Our goal: innovative crypto investments with sustainable added value.

Tireless transformer and organizer. Our successful serial entrepreneur combines strategic thinking with a keen sense for new market opportunities.

Specialist for day-to-day trading. Our former professional athlete identifies crypto trends and is responsible for the active part of our portfolio management.

Analytical backbone and visionary of our team. Our former university professor provides data-driven insights, assuring scientific precision of our fund investments.

Talk to us

Email: getstarted@f5crypto.com

Phone: +49 157 501 821 56

Your Next Steps

-

Personal Consultation

– Arrange a free call with a fund manager. -

Digital Onboarding

– Fill out the required documents conveniently online – quickly and securely. -

You are invested

– Your fund shares are transferred into your traditional brokerage account.