Crypto’s Reign Begins Now: How Stablecoin Regulation Enables the Entire Crypto Market to Grow

Open blockchains massively improved the holding and transferring of assets. Holding is possible without any counterparty risk. Transfers are instant, global and without approval from third parties. In addition to these incredibly strong property rights, Bitcoin, with its fixed supply, has evolved into a store of value that is starting to rival the king: gold. The price of bitcoin has risen phenomenally since inception and is yet to reach a long-term equilibrium. We believe Bitcoin still has at least a decade of growth left.

Bitcoin, Ether and Solana are native blockchain tokens. Now, increasingly, open blockchains handle non-native tokens. The largest among these are dollar-tokens, so-called stablecoins. Stablecoins have seen unprecedented growth in adoption, comparable to Bitcoin. This year, the GENIUS Act in the US and to a lesser extent the MiCaR in the EU, have laid the groundwork for this growth to accelerate even further. The abundance of blockchain-dollar-tokens will now open the floor for other non-native tokens to move onchain. This development unlocks a massive growth potential throughout all of crypto. Our F5 Crypto Fund is positioned for this future, providing investors with access to high-potential returns.

How the need for Dollars without a Bank led to the world’s most profitable Business

In 2012, the crypto exchange Bitfinex was founded. The exchange grew quickly. However, in 2013-2014, traditional banks began freezing Bitfinex’s accounts and blocking customer transfers. Throughout the 2010s, many crypto traders faced the same problem: Moving fiat currencies like US-Dollars between exchanges and countries through the slow, fragmented and often hostile traditional banking system proved unreliable.

In 2014, members of Bitfinex launched a dollar token on Bitcoin’s Omni layer called Realcoin. Shortly thereafter, it rebranded as Tether. These dollar tokens could be transferred at the speed of blockchains: instantly, globally, without transaction censorship. They quickly gained popularity. From 2017 to 2018, Tether’s USDT (USD-Tether, the ticker for the dollar-token) supply grew from tens of million to several billions. During this period, the BTC/USDT trading pair eclipsed the volume of all other BTC pairs, sometimes cited as high as 80% of all Bitcoin trading volume.

Unsurprisingly, people began questioning Tether’s legitimacy. Were those dollar tokens truly backed by real dollars? Did Tether manipulate the Bitcoin price? A widely cited paper alleged Tether’s dollars were unbacked and used to inflate cryptocurrency prices.

In 2019, the New York Attorney General sued Bitfinex and Tether, alleging that Bitfinex had lost access to $850 million in client funds and used Tether’s reserves that were supposed to back USDT to cover the shortfall. Many a crypto-commentator thought this would mark the end of Tether. A collapse of Tether would drag down the entire crypto market with it.

Tether and Bitfinex neither collapsed nor shut down. Tether settled, agreeing to pay $18.5 million in penalties, without admitting any wrongdoing. Tether not only survived, it thrived.

In early 2023, Cantor Fitzgerald, the Wall Street firm managing a portion of Tether’s reserves, publicly stated that Tether’s tokens are indeed fully backed by the assets it claims, pushing back against long-standing doubts about its solvency.

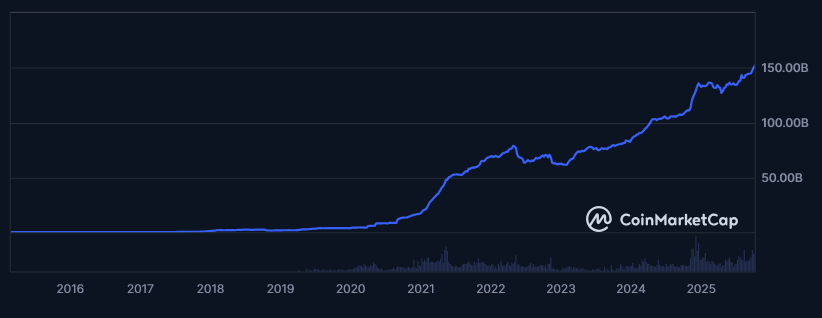

Today, Tether has grown into a giant. Its circulating supply of USDT above $150 billion generates roughly $7 billion in annual risk-free revenue from underlying US treasuries. In 2024, Tether reported approximately $13 billion in net profit.

The jaw-dropper: Tether operates with a remarkably small team. The headcount is estimated at 100-200, putting its profit-per-employee metric in the range of $50 to $100 million. This makes Tether the most profitable company per employee globally.

Tether has grown from fulfilling the need to have dollars without a bank to becoming the most profitable pseudo-bank in the world. In September 2025, Tether announced a funding round at a $500 billion valuation. This would place Tether among the top-20 most valuable companies worldwide, comparable to Netflix and Mastercard.

The Tether story mirrors the Bitcoin-story. An unproven, unregulated niche idea evolved into one of the most profitable businesses on the planet.

Stablecoins Cement Fiscal Dominance

Stablecoins originated as a tool to trade Bitcoin without using banks. Now, their primary role is no longer crypto trading, but enabling global commerce.

Businesses in Turkey, plagued by devaluation of the local Lira currency and forced conversion of bank USD deposits into the weaker local currency, are increasingly opting to use USDT and other dollar stablecoins. Expats living in the UAE buy apartments and pay their bills using USDT. Supermarkets and coffee shops in Buenos Aires accept USDT as a preferred alternative to the argentine peso.

These examples highlight how the US-Dollar is gaining a foothold in many countries through both it’s status as the stronger currency and through the superior blockchain infrastructure, allowing instantaneous transactions 24/7 globally.

The US-administration has recognized the strategic importance of exporting their currency through the use of blockchain-tokens. Maintaining the global currency reserve status for the US-Dollar may in the future partially rest on US-Dollar stablecoin distribution. To cement fiscal dominance through stablecoins, the US has passed sensible regulation.

US Stablecoin Regulation: GENIUS

Stablecoins like Tether’s USDT grew while being unregulated. The risk particularly of unbacked tokens was high. Eventually, regulators had to either shut stablecoins down or reign them in. Reign in they did.

Early 2025 the GENIUS Act was first introduced in Congress. On July 18, 2025, President Trump signed it into law. It will take effect 4-18 months thereafter, depending on the speed of federal regulator implementation.

The Act is sensible, simple and straightforward. Only permitted entities can issue stablecoins onchain, which must be fully backed by segregated low-risk assets (largely US-treasuries). Disclosures on backing must be public. Operators must be AML compliant. Issuers above a $10 billion threshold must register federally in addition to their state supervisors.

GENIUS had massive direct impacts. Online payments giant Stripe acquired a stablecoin infrastructure firm for $1.1 billion and is aiming to become a stablecoin issuer. Stripe also announced a new L1 blockchain called Tempo. Swift, the interbank communications company, is building a blockchain for tokenized assets for global interbank flows. Tether, meanwhile, is working on a US-compliant stablecoin alongside their unregulated, likely soon non-US facing USDT. They also announced a new L1 blockchain in Plasma, that already launched in September 2025.

EU Stablecoins under MiCAR lag behind

Meanwhile, in Europe the MiCAR has rules for e-money tokens (EMTs) in place since 2024. Unfortunately, MiCAR compliant stablecoins are severely lacking thus far. This can be partially attributed to overarching rules. One rule requires issuers to not only fully back their tokens but to hold additional reserves. Another forces issuers to spread reserves among different banks. Additionally, only already licensed credit institutions can issue stablecoin, shutting down most start-ups.

In September 2025, a consortium of 9 EU banks announced plans for stablecoin. There is no name for the project yet and no CEO leading the charge. The launch date is set for Q3 2026. Meanwhile, Tether’s USDT is not MiCAR compliant and has been delisted from all regulated EU-exchanges in 2025.

It is unfortunate how the EU managed to both ban the most liquid stablecoin USDT while regulating so tightly that no local EU stablecoin stands a chance to take its place. I expect USDT to reign supreme globally, while Circle and other regulated US-issuers will dominate the regulated US and EU markets.

The Onchain Token Future

Regulated stablecoins from issuers like Circle, Stripe, likely Tether and potentially an EU-bank-consortium will increase Dollars and Euros available on public blockchains. Unregulated stablecoins from Tether will keep increasing as well, as many of the users in the global South primarily care about access and liquidity.

Having Dollars and Euros onchain unlocks the full onchain economy. First are payments. Buying the proverbial coffee with blockchain-tokens will finally become reality. More importantly, salaries, bill and rent payments can now migrate to using these new rails, as the UAE has already shown with USDT.

The next step are other tokenized assets. Stocks and bonds, for example, trade on traditional rails, with all their restrictions. Blockchain trading is open 24/7/365, settles in seconds instead of days, and is globally accessible. Trading venues will recognize these advantages and offer stock-trading onchain. Issuers of bonds will dip into on-chain liquidity, issuing bond-tokens. Step by step, most financial activities will go onchain.

F5 Crypto Funds positioned to profit from Stablecoins

We are witnessing in real time how finance is migrating to open blockchains. Holding and transferring safe, regulated Dollars and Euros are the basic functionality that most other financial applications require.

At F5 Crypto, we see analyse onchain financial businesses (OFB) that already supply the market with working, revenue generating, applications. We are looking at decades of growth for these OFB.

Learn more how we understand the market and invest in it for our investors:

On the backbone of incredibly strong property rights and fast settlement times of open blockchains, Bitcoin thrived and is looking to dethrone gold in the next decade.

By issuing stablecoins on these open blockchains, Tether was able to build one of the world’s most valuable businesses.

We believe a next step in the evolution of onchain finance is the tremendous growth of onchain financial businesses. Investors in our F5 Crypto Fund will greatly benefit from this trend. Professional investors can invest from 50,000 EUR, semi-professional investors from 200,000 EUR. Subscriptions are open. Contact us today.

In September, F5 Crypto acquired a second fund. Investors in the SwissRex Fund will likewise participate in the growth of the onchain economy. Read more about the acquisition in our announcement.