Do you own your cryptos?

This is the first part in a series of articles about basic questions you as an investor should ask your crypto-asset manager. ‘Basic’ does not mean ‘simple,‘ but ‘fundamental:‘ get one answer wrong, and you may find you do not own “your” cryptos after all. Thus, you need solid responses, and every reliable asset manager will provide them in written and binding form. Cover all questions – including if you decide to be your own manager.

Your asset manager manages your assets: therefore his first responsibility must lie in making sure they become and remain your assets – not for a while, but until they are to be sold and under all circumstances. Even unforeseen ones, like the most famous US crypto exchange being a fraud.

You might think the question is moot: after all, we don’t usually worry whether we truly own our property. You buy a car, and you own it. You buy an espresso, and you drink it. What else?

So why would it not be the same with crypto assets? You buy a bitcoin, and own it. What could go wrong?

The short answer is: the very same things which could go wrong when you buy a car – only that with the car, you know what to look out for, while for cryptos the risks appear “hidden” just because they are more uncommon and abstract. ‘Keys,’ for instance, look quite different. For most of us, experience turns out a less reliable guide, and so extensive debates abound and confusion ensues.

What does it mean to “own” crypto assets?

Debating “do I own it?” is more confusing for cryptos than for cars because 3 distinct aspects all need to hold true for you to actually own your digital assets in the way commonly described as ownership.

Yet most people discuss only one of those aspects:

- the technical question: who has the keys?

- the legal question: who has the right?

- the practical question: who gets control?

Technical ownership = holding the keys

At the fundamental level of the blockchain, crypto tokens are secured via cryptography: you can generate a valid transaction spending your coins if and only if you are able to sign that transaction with your private keys (and publish it successfully).

This mimics closely the fact that you can drive a car if you possess the car’s keys: purely on a technical level, you indeed are empowered to move the car/coins wherever you please.

For a lot of crypto enthusiasts, this insight has become a mantra: “not your keys, not your coins.”

Clearly they have a point: who gets physical control over an asset is of key importance; mistakes can lead to catastrophic consequences. We do not store the bank vault’s key in a key cabinet next to the entrance door; we refrain from entrusting prison-cell keys to inmates; we surely do not want the Gold Codes in the wrong hands.

However, assuming that access to the keys confers ownership of the asset is too simplistic. Obviously nobody would think so regarding valet parking or car rentals.

The same applies to crypto assets: Rapper Heather Morgan and her husband Ilya Lichtenstein had the keys to 119,000 BTC, “owning” some appreciable wealth currently worth 6.4 billion GBP – yet they barely dared to spend miniscule fractions of it on Walmart supermarket vouchers.

Which promptly got them arrested. Currently, they face 10 respectively 20 years in prison, having pleaded guilty to money laundering and conspiracy to defraud (only Morgan). Just as the valet gets hold of keys to cars he will likely never in his life be able to afford, they held the keys to crypto assets they never stood a chance to fully spend. After all, the Bitcoin came from the 2016 Bitfinex hack.

Being able to move an asset may be necessary, but it clearly is not sufficient to own it in any meaningful sense.

Car rentals also showcase another common misconception: as any car-rental owner will confirm, keeping all keys to yourself is not smart. Would you feel safer if you never handed over your car key to your trusted garage, and as a consequence drive a vehicle with all repairs carried out by yourself?

Security is never unidimensional: minimising the risk of losing your car to your garage’s mechanic does not minimise the risk of losing the car to technical failure. Minimising the risk of losing your crypto by never owning any unless in self-custody will not minimise the risk of economic failures: excessive transaction costs, unavailability for trading at crucial times (e.g., delays when loading into hot wallets during market crashes), fewer rebalancings, in short: a sub-optimal investment portfolio.

Importantly, these are economic losses for the computer-science savvy of utmost diligence who can rely on an ultimately trustworthy storage technology. Yet self-custody does not ‘fail gracefully:’ Any mistake likely entails an irrecoverable –100% return. After all, the BTC that Morgan and Liechtenstein ended up having control over (until 2022) where originally managed by one of the industry’s most professional crypto exchanges, too.

My personal rule of thumb is to only ever consider securing sizable wealth in self-custody given that you can look back on several years of managing the keys to your e-mail encryption without a single incident. Not only your keys, not only your coins.

Otherwise, you are more likely to end up in a predicament like James Howells: he has offered millions to his local landfill to be allowed to dig through 110,000 tons of garbage in order to find a hard drive he mistakenly threw out. The drive “securely” holds the key to 8,000 BTC (currently 500 million €).

Failsafe security is never easy to achieve, and most investors are well advised to leave the technical issues of crypto investments – like key management – to professionals. It is easier to do a good job in the due diligence of a crypto-asset manager than to maintain the diligence due in the job of crypto-asset management.

Why is safeguarding technical ownership harder for cryptos? Carrying car keys is not commonly felt as burdensome. The difference is not conceptual: Both car keys and crypto keys share the same two security requirements:

- you must not lose your keys, and

- nobody else may get hold of your keys.

In both cases you can lose control of the asset. However, the consequences in an adversary-rich, always-online, global digital system are incomparably harsher.

First, the likely consequences are different: It is not uncommon to forget car keys in the parked car – and upon return find them again, absolutely undisturbed. Crypto keys leaked online will frequently lead to the corresponding assets being gone in less than 60 seconds.

Second and more importantly, the legal consequences are different: A dishonest mechanic may abscond with your car, but he cannot sell it. The keys only confer physical control, likely fleeting, as legal ownership is vested in a different token, the car title (V5C logbook).

Legal ownership = granted the right

As Morgan and Lichtenstein learnt, cryptos do not exist in a lawless parallel universe. The key question for any serious investment naturally is whether the law supports the ownership right.

Clearly ‘ownership’ is first and foremost a legal term, enforced by the rule of law. If a driver runs off with somebody else’s car, the government will employ force to return it to its ‘rightful owner.’ And while all armies in the world are powerless against strong cryptography, and thus no government can generate “spare keys” to a secure crypto wallet, effective control over the on- and off-ramp into the “real world” (KYC, AML) has by today made sure that cryptos are far less useful, and thus far less used than traditional means, for activities prohibited by law.

Yet… which law?

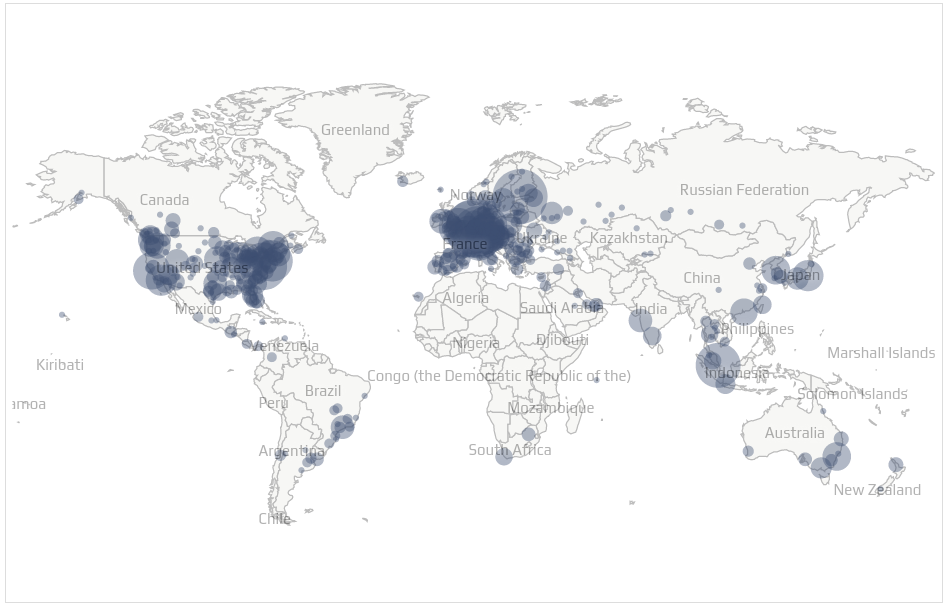

While cars reside in a jurisdiction; cryptos live in virtual cyberspace, quite divorced from material realities. With Bitcoin, for instance, once a transaction enters the blockchain, it will be mirrored on currently 18,413 full nodes spanning 92 jurisdictions (with the vast majority located in the 93rd country called “n/a“).

Which jurisdiction does “legal” then refer to?

You cannot hope for a legal right in every jurisdiction of the 193 member states of the United Nations, for the simple reason that in a sizable number of countries, the law prohibits (e.g., Algeria, Egypt, Nepal) or does not protect (e.g., China) ownership of cryptos.

Yet why would you care about some foreign countries’ laws? Surely they do not apply to you, comfortabe in your home country, likely blessed with solid crypto regulation if you read this?

Practical ownership = able to spend

Then all is fine if you hold the keys and “your” law condones your ownership?

Not if you cannot sell or move your crypto assets as you deem fit.

Famously, “the whole point of money lies in getting rid of it.”

Yet why shouldn’t you be able to enjoy the proceeds of your legally owned and securely stored crypto assets?

You should; no question about it. Yet you still may simply not be able to enforce your right:

- Using privacy-preserving tools is perfectly legal in most jurisdictions. Nonetheless, coins that have been through a mixing service frequently are refused to be processed by crypto exchanges and banks. And unless you are in El Salvador, where Bitcoin is legal tender, nobody is under the obligation to accept your tokens.

- Another frequent problem in enforcing “legal ownership” stems from foreign laws encroaching your jurisdiction. For instance, online gambling, while heavily regulated, is not illegal in most of Europe. Yet the most prominent on-chain analytics company Chainalysis red-flags coins coming from online casinos based on the legislation in the US, where it is headquartered. Since many European banks, brokers, and exchanges rely on Chainalysis to avoid dealing with illicit tokens, perfectly legal coins may end up being difficult to liquidate.

- Even if you managed to ensure all your coins, over their entire history, have never been involved with anything deemed illegal, can you ensure you can transact?

Due to much stricter regulatory scrutiny than in any other asset class, centralised exchanges and other custodial service providers may be quick to temporarily freeze funds in order to re-verify their know-your-customer (KYC) procedures. With a certain irony from the perspective of the crypto ethos, such obstacles can only be well addressed by transacting via a reputable institution.

Many more examples abound. The bottom line is clear: you cannot content yourself with technical and legal rights (in some jurisdiction) to your crypto assets. What ultimately matters is the very practical concern: can you dispose of your crypto assets at fair market values without complications whenever you wish?

Of course, as truckers protesting the Canadian government’s policy found out, money in bank accounts is significantly more vulnerable than crypto assets are. Nobody even imagines he could get the technical possibility to transfer euros from a bank account without the bank’s approval.

Yet unless protests against the epidemic policy are declared a national emergency by the prime minister, that’s precisely the point: everybody knows what to expect.

Wire transfers are inherently what Brett Scott, in his decade-long, highly insightful dismantling of the ‘War on Cash’, has so aptly termed a “‘have your people talk to my people‘ affair.”

For crypto assets, you must make sure there are no surprises: neither about the technical, nor legal, nor practical availability of all capital, at any time. Either by handling all those issues yourself, or by delegating your crypto management to competent professionals for whom this is part of their daily job.

Conclusion

The exact extent to which digital assets are best held in self-custody and what fraction is best delegated to an asset manager and custodians depends on individual circumstances – however, in many cases it will not be a binary matter, but rather a question of how much in each?

Generally speaking, small amounts for convenient payments (acting as media of exchange) are ideally in self-custody, even if only on a private smartphone; several percent of one’s net worth (as an appreciating store of value) are in most cases best managed professionally.

The tricky part: almost all crypto-asset managers promise you “ownership” of crypto assets – yet not all ownership is equal. I have provided 3 fundamental perspectives a diligent investor will clarify separately when thinking and talking about crypto ownership. A follow-up article will dive deeply into the practical matters of different ways to own cryptos. Follow us on LinkedIn to not miss it.

And yes, if you wanted to ask: Naturally, we have set up our F5 Crypto Fund very consciously optimising it to provide investors with the most reliable ownership rights. In our view, this is key for large investments. And necessary, so we can say: Crypto ownership, simple and secure.