Small-Cap Assets: No Small Matter? A Case Study on PYTH

Bitcoin ETFs, tokenised Ethereum money-market funds, Solana ETPs: Following a decade of widespread crypto skepticism in the financial industry, the mood is shifting – and with it comes the question: are these conventional financial instruments sufficient for crypto investments?

The answer is a resounding no.

As an illustration, consider the position taken by the F5 Crypto Fund in PYTH back in December.

Why PYTH?

PYTH, the token of the Pyth Network, provides a prime example of an attractive small-cap altcoin:

- It is the token of a promising project,

- Pyth Network, the high-speed blockchain oracle, is challenging the market leader Chainlink at a time when more and more dApps are relying on speed.

- The strong integration of primary sources provides a competitive advantage not easy to replicate.

- The integration of Pyth is already remarkably advanced, including with Cboe, TradingView and Solana’s DEX aggregator Jupiter.

- which has not yet received its due attention in the market,

- The token is young, only tradable since November 2023.

- At the time of acquisition, it flew under the radar of many as it was outside the top 100 cryptocurrencies by market cap.

- By launching on Solana first, Pyth emerged from an ecosystem alternative to Ethereum.

- and its growth potential is only accessible via ownership of the token.

- While PYTH is “only” a governance token, Uniswap’s single-day surge of +60% in February proved how easily successful projects can introduce rewards for token holders later.

- Above all, there is no ETP or any other traditional financial instrument to participate in the success of Pyth Network: only those who buy PYTH benefit from it.

Performance

What we at F5 Crypto also like about PYTH: it is the fund’s position with the strongest recent performance:

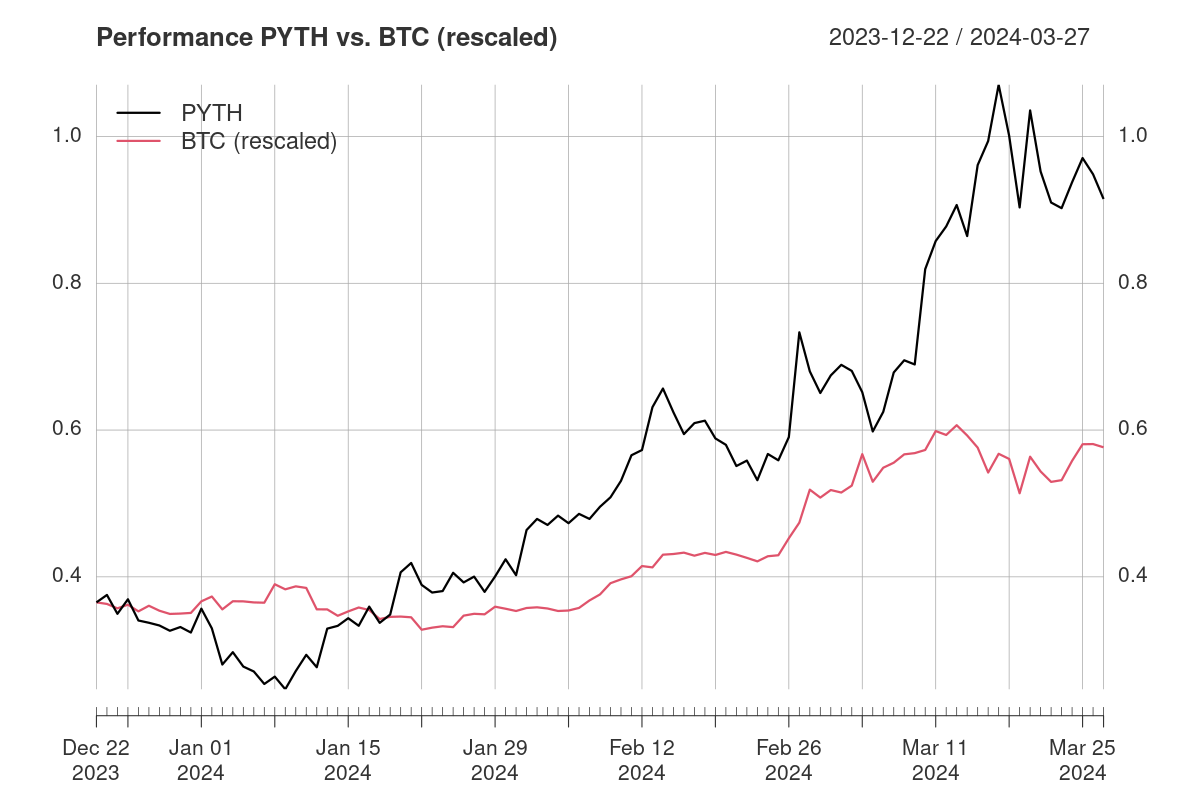

In the last 90 days alone, its price surged by +169.0%. Not annualised.

This performance also notably surpasses the excellent returns of Bitcoin, which saw a gain of +64.2% during the same period

Of course, it is no news that individual cryptos can deliver outstanding gains. Yet also a professional crypto fund will only allocate relatively small positions to small-cap coins.

Is such an individual return even relevant for an optimised portfolio?

How to measure the relevance of a position

In finance, there is an established measure for this purpose: the return contribution.

The return contribution of a position is the percentage share of the total portfolio return attributable to that individual asset:

Formally, contributionPYTH = weightPYTH * returnPYTH / returnPortfolio.

- In line with intuition, this way all performance contributions add up to 100%. After all, the portfolio return is but the weighted sum of its constituents’ returns: returnPortfolio = Σi weighti * returni for i = 1, …, N.

- However, individual positions can contribute negatively – for example, loss positions to a positive portfolio return.

- An individual contribution can also make up over 100% (which is offset by other returns).

What is the specific return contribution of PYTH in the F5 Crypto Fund?

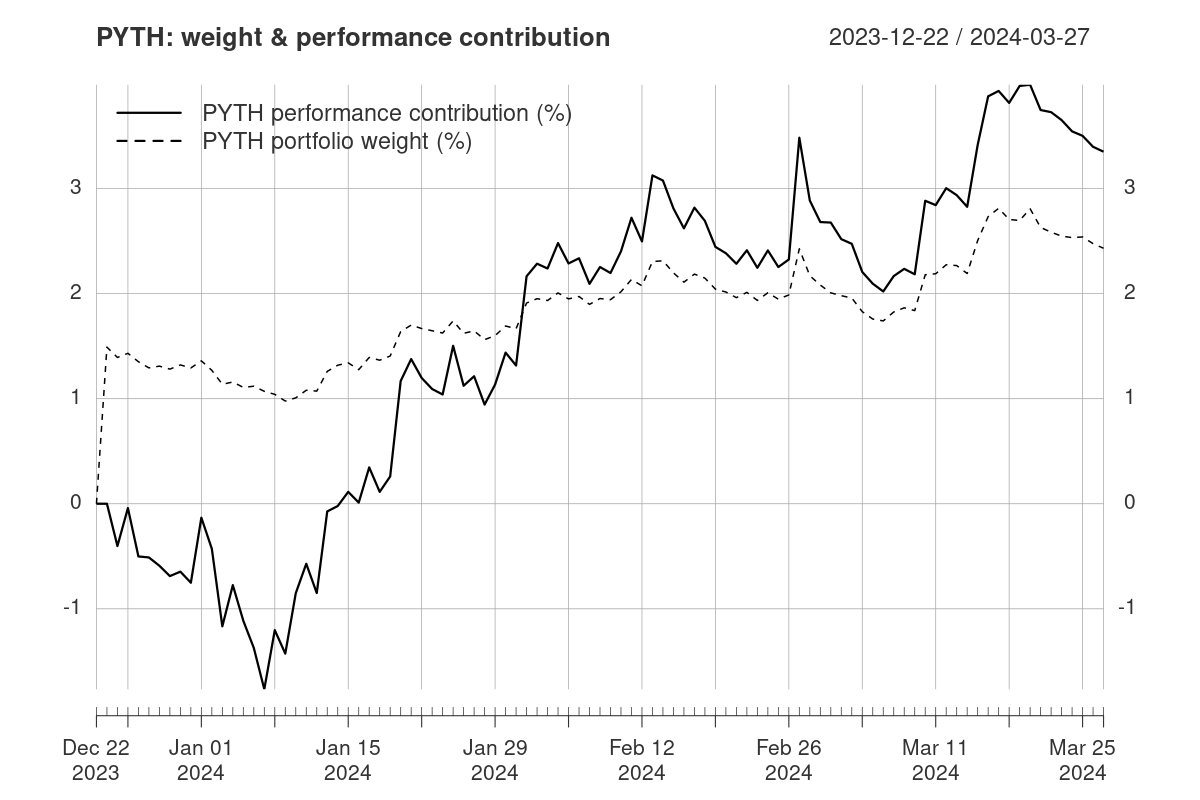

The fund’s PYTH position was opened last December with 1.5% of assets under management. Benefiting from its above-average performance and the strategic decision to allow profits to accumulate, the position has grown to currently 2.5% of the AUM. So what contribution did an average of 1.82% of AUM make to the overall fund performance during this period?

Although the PYTH position was actually opened a little too early, resulting in a negative performance contribution of −1.77% until January 7th, PYTH not only made up for this setback within a single week, but also achieved a contribution of almost 4% in the following 2 months.

While BTC contributed 0.8 times its average weighting to the fund’s performance during an extremely strong phase, PYTH delivered a contribution of 1.84 times its weight – more than double compared to Bitcoin.

What do strong return contributions from small-cap assets mean?

The conclusion is simple and obvious: The cryptocurrency market offers a breadth of opportunities that surpass the accessibility provided by traditional financial instruments such as ETFs and ETPs.

- Emerging small-cap crypto assets offer significantly higher return opportunities than Bitcoin, Ethereum and other already established tokens.

- For solid investments, the fundamentally best projects must be identified. Memecoins are speculation; charlatans and impostors mimic breakthroughs; but those who separate the wheat from the chaff will find the architects of the future internet.

- The tokens of these projects must be purchased on-chain and stored securely.

Hence comes the common crypto credo: “Do your own research!”

So I need to find such promising small-cap tokens all by myself?

For private investors, the short answer is: Yes.

For (semi-)professional investors, the F5 Crypto Fund offers the ideal alternative: It handles the entire process from fundamental analyses to portfolio optimisation to secure token purchases and BaFin-licensed cold-storage custody to delivery of the fund shares into investors’ securities accounts. This way, they participate not in financial derivatives, but directly in the crypto market.

Including the return contributions of the most attractive small-cap crypto assets.

Not only, but also from PYTH.

Remarks

This case study is provided for informational and educative purposes: it is not investment advice.

If you prefer, you can read the original German version of this article.

The translation of this article was aided by artificial intelligence.

Price data are daily close prices from CoinMarketCap.

All calculations and plotting were done in GNU/R.