F5 Crypto Fund

Overview

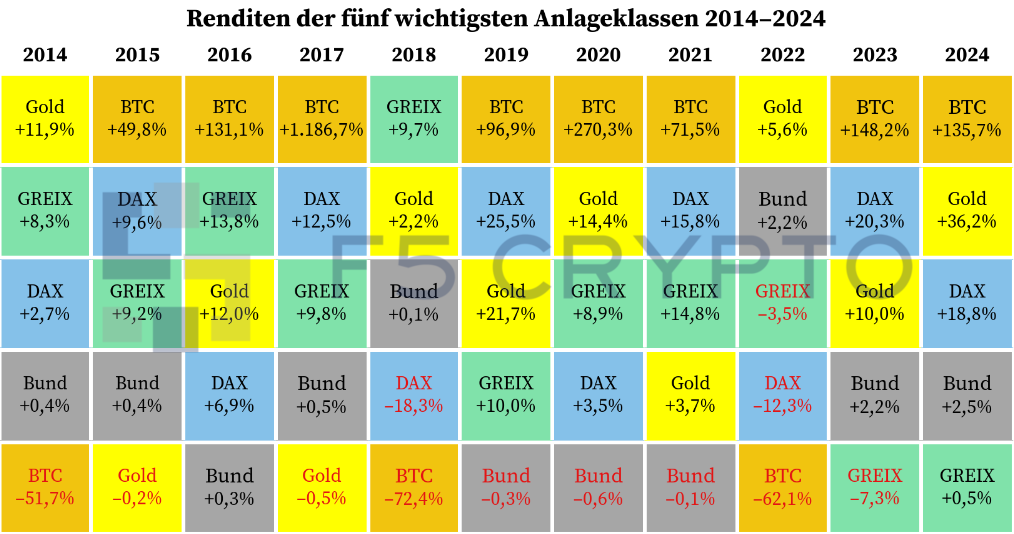

Crypto assets are the asset class with the highest expected returns. The F5 Crypto Fund invests in the best tokens with strong fundamentals. Investors can join the F5 Crypto Fund anytime.

Easy to invest and under the supervision of the German financial authority “BaFin,” the F5 Crypto Fund buys the most promising crypto tokens directly, using secure trading and safe custody. Investors in the Fund benefit from price appreciation while enjoying peace of mind.

Investors can monitor their Investment at all times in their custom fund-dashboard.

Request your demo-dashboard.

Investment Objective

The fund’s objective is the long-term growth of its invested capital via an optimal, diversified portfolio of native crypto assets. The actively managed fund pursues discretionary investments based on fundamental analyses of the most promising crypto assets and exploits inefficient valuations in this new asset class.

Investment Theses

The onchain economy will keep growing. As in any growing economy, new businesses carve out markets and generate profit. These new onchain businesses are investable now at low valuations; like Amazon or Netflix in the 2000s when the internet was still young. We believe that

- Finance is moving Onchain.

- Onchain Financial Service Businesses (OFSs) will generate large profits.

- OFS issue tokens instead of traditional shares.

- OFS tokens are available now at extremely favorable valuations.

- Our team identifies promising tokens reliably.

1. Finance is moving Onchain

Bitcoin is a technology to store value. By introducing digital scarcity combined with a way to hold and transfer without third parties, Satoshi’s invention of Bitcoin created a new type of asset, a kind of digital gold. Since it’s existence, Bitcoin has been the best performing asset frequently.

Bitcoin demonstrated that holding and transferring value without a company or state works.

The second large type of asset that is moving onchain are Dollars in the form of dollar-tokens, so called stablecoins. Stablecoins have reached over $200 billion in market cap. On the success of the technology, the EU and the US have passed stablecoin legistation. The first stablecoin company, Circle, is public.

Soon, more financial assets will move onchain. The onchain infrastructure is superior to traditional ownership documentation. Land registers, municipal court share registers and central depositories will, in time, all be partially or fully replaced with a blockchain. This transition will happen slowly piece by piece.

2. Onchain Financial Service Businesses will generate large profits

Assets live onchain. They are transferable, tradeable and can be used in financial contracts 24/7/365.

The two most common types of financial activity onchain today are trading and lending.

A trade converts one asset to another. Onchain exchanges facilitating trades are called decentralized exchanges (“DEX”). Many operate without order books, instead using an automated market maker (“AMM”) to price assets and provide around the clock, automated liquidity.

A loan issues one asset against another asset as collateral. Like a DEX, a decentralized loan protocol issues and redeems loans automatically without human intervention. Cost of borrowing rates emerge naturally. Most importantly, good lending protocols handle liquidations in real time automatically.

Businesses offering trading and lending onchain earn fees. In 2024, total DEX trading volume is estimated at $1.2 trillion with an average fee around 0.15% for about $1.8 billion in revenue. Lending yielded even more revenue at a roughly estimated $3 billion.

Both the types and the volumes of onchain assets are growing. As the asset base grows, the financial activity will grow as well, generating increasing fees. The onchain businesses collecting these fees will see their profits grow.

3. OFS issue tokens instead of traditional shares

Most onchain businesses organize themselves in a new type of company called a DAO, a decentralized autonomous organization. These DAOs operate much like a regular company: there are ownership rights and profit-sharing rights. In an ideal case, these rights are guaranteed by onchain code and expressed by onchain tokens. For example, a protocol might have a rule to distribute profits quarterly to token-holders. This profit calculation and distribution happens automatically onchain, without an account for calculation or a bank account to make transfers. Changes to this automatic profit distribution would require a two-thirds majority vote of token-holders.

The benefits of tokens instead of traditional shares are many. The rules governing tokens are public, transparent, and execute predictably. DAOs typically operate without a traditional jurisdiction, allowing international access and freedom of structure. Tokens themselves can be minted, redeemed, transferred and traded onchain.

Given all these benefits, modern onchain financial service businesses elect to issue tokens instead of going the traditional incorporation route. Some OFS also elect to chose a dual structure, with both a traditional company and an onchain DAO. Analyzing these constructions carefully is paramount to investment success.

4. OFS tokens are available now at extremely favorable valuations

Many Onchain Financial Services on the blockchain have issued tokens that grant both voting rights and profit-share rights. These tokens trade freely on centralized exchanges such as Coinbase, Kraken and Binance.

The market for OFS tokens is dominated by casual investors who follow trends and narratives. Traditional investors often have no access to these markets. Large financial institutions in 2025 still struggle square the simple acquisition of Bitcoin with their bylaws. Smaller, newer OFS tokens are completely off limits for many large investors. As such, F5 Crypto is one of the few professional investors looking at OFS tokens using proper valuation models today.

The gap between a trend and narrative based valuation and an FCF based valuation can be extremely large. In our view, many crypto tokens available for trading are, in line with their bad reputation, massively overvalued, riding on waves of expectation that are wildly unrealistic. On the other hand, a few select OFS have demonstrated product market fit, earn growing revenues over several years, yet have their tokens valued at small multiples, making for very attractive investments.

5. Our team identifies promising tokens reliably

Our F5 Crypto team has a unique track record in identifying trends and risking money and career on these predictions.

Paul Otto, our Chief Investment Officer, has studied Bitcoin intensely in 2013. A year later, he finally had the conviction to open a 10% position of his private net worth in Bitcoin.

Florian Döhnert-Breyer, one of our Fund Managers, has written his Master thesis on crypto ETFs in 2017. In 2024, the first crypto ETFs went to market.

Prof. Dr. Hermann Elendner presented the first Blockchain lecture in 2017. He left academia in 2022, joining our team full time.

Monthly Investor Reports

| Report |

Publication

|

|---|---|

| F5 Crypto Fund Report – August 2025 | 08.09.2025 |

| F5 Crypto Fund Report – July 2025 | 06.08.2025 |

| F5 Crypto Fund Report – June 2025 | 04.07.2025 |

| F5 Crypto Fund Report – May 2025 | 10.06.2025 |

| F5 Crypto Fund Report – April 2025 | 08.05.2025 |

| F5 Crypto Fund Report – March 2025 | 09.04.2025 |

Fund Managers

- Serial tech-entrepreneur

- Early-stage crypto investor

- Master thesis on crypto ETF

- Finance Professor at 30

- Lectured about Blockchain since 2017

- F5 Crypto Index Developer

Fund Details

| Name | F5 Crypto Fund |

| Date of Establishment | 15.12.2021 |

| Fund Type | Open-Domestic Special AIF in accordance with the German KAGB |

| Investment Fund | F5 Crypto Fonds 1 InvAG m.v.K. und TGV |

| Capital Management Company | F5 Crypto Management GmbH |

| BaFin-IDs | 40031947, 70163204 |

| Indicative Unit Price (2025-09-15) | 1,14 € |

| Management Fee | 2% p.a. |

| Performance Fee | 20% with a 6% Hurdle Rate and High Watermark |

| ISIN Class A | DE000A3C5QX6 |

| WKN Class A | A3C5QX |

| Minimum Investment | 200,000 € for semi-professional investors 50,000 € for professional investors Accepting stablecoin subscriptions |

Performance

Performance graph of the F5 Crypto Fund

Risk Management

The F5 Crypto Fonds 1 reduces the volatility inherent in crypto markets via its scientifically based state-of-the-art Value-at-Risk (VaR) risk management tool, developed by Prof. Hermann Elendner. Additionally, the risk management of short and mid-term positions relies on stop-loss and take-profit orders.

Portfolio Insights

Legal Setup

The F5 Crypto Fund operates as a publicly accessible Special AIF in accordance with § 282 of the German KAGB. Operation of the fund falls under the purview of the external AIF fund management entity, F5 Crypto Management GmbH, registered under § 2 (4) of the KAGB. The fund is available for investment for semi-professional investors starting from 200,000 EUR and for professional investors starting from 50,000 EUR. Since 2021, the fund has been one of the first open cryptocurrency funds in Germany.

Service Partners

View the full legal disclaimer at https://f5crypto.com/disclaimer.