Strategy phase shift: F5 Crypto Fund starts rotation into smaller coins

The F5 Crypto Fund has initiated the next phase of its asset-allocation strategy: the gradual shift away from previously heavily overweighted large caps, moving to mid-cap and small-cap assets. Why are we reducing our Bitcoin exposure right now?

Our view on the current market

In analogy to the stock market, we categorise the crypto market into three size classes:

- Large cap

- Mid cap

- Small cap

- Here we subsume all the thousands, indeed tens of thousands, of smaller projects.

The significantly higher skewness in the distribution of market capitalisation, as opposed to the stock market, is the reason why we classify only the top 2 coins, BTC and ETH, as large caps: these top two assets represent more than 2/3 of the total capitalisation of the cryptocurrency market, exceeding a trillion euros.

Due to their prominent position, these two coins exhibit by far the lowest fundamental risks and comparatively lower volatilities. Moreover, at the onset of a crypto bull market, BTC has historically served as the bellwether, attracting attention first. For these reasons, over the past two years, the F5 Crypto Fund overweighted large caps (as well as actively managed the cash position).

What has changed since 2024 kicked off?

- Exactly as predicted, Bitcoin has once again fulfilled its bellwether role: With a return of +148.2% in 2023, despite historically lower volatility, BTC notably outperformed other top cryptocurrencies. (ETH +85.3%, BNB +23.3%, XRP +75.8% despite its big jump after last year’s court decision).

- January 10th saw the long awaited approval of spot ETF on BTC finally granted by the SEC.

- In short, it’s not about a sudden isolated event, but due to the emerging consensus: the bear market is over, and a new cycle is commencing – “right on time” for the upcoming halving.

Given that precise turning points in price trajectories can only be identified in hindsight, the F5 Crypto Fund does not fully shift between large-cap and small-cap assets all at once on a fixed date. Instead, we execute a gradual rotation: the weighting of initially mid-cap and subsequently small-cap assets, which exhibit higher return potential, is increased in several stages.

Following the ETF approval, the first phase of this strategy was successfully executed.

How did we reallocate in detail?

Bitcoin (BTC) was significantly reduced immediately after the ETF approval.

Bitcoin (BTC) was significantly reduced immediately after the ETF approval. - Prior to the approval of the ETF, many were anticipating the SEC decision to ignite a price rally. F5 Crypto’s assessment, however, was contrary: inefficiencies in the cryptocurrency market are found in altcoins – not in Bitcoin, the most established, renowned, and liquid crypto asset that is extensively covered by derivatives and by now well established in traditional financial markets. In those, such a clearly impending event is reflected in prices well before the official announcement.

- The fund thus achieved a return of +159.8% on BTC in the year leading up to the ETF approval, with its overweighted position (which varied over this period), then reduced it just before an almost 10% decline in the past week.

Stacks (STX) was liquidated.

Stacks (STX) was liquidated.- Stacks (STX), as one of the few Bitcoin layer-2 solutions, exhibits a strong correlation with BTC but is significantly more volatile. Given that our fundamental analysis does not see a long-term perspective for Stacks that justifies its risk-return ratio, the position was completely closed after the ETF approval. Opened last June, the position thus yielded +161.5% in a little over half a year. In doing so, the fund also avoided the price decline of –15.3% in the past week since the sale.

The Ethereum ecosystem was overweighted, particularly Arbitrum (ARB) and Optimism (OP), as well as Rocket Pool (RPL) and Lido (LDO).

The Ethereum ecosystem was overweighted, particularly Arbitrum (ARB) and Optimism (OP), as well as Rocket Pool (RPL) and Lido (LDO).

- Instead of the anticipated price movement in BTC, it occurred more significantly in ETH: While BTC fell, the second-largest cryptocurrency is trading +8.6% higher one week after the approval, as compared to the closing price the day before the decision – a return differential to Bitcoin of over +15% within a week. The fund’s reallocation into the ETH ecosystem thus occurred at precisely the right time.

Our investment philosophy takes a long-term perspective. Therefore, we emphasise that individual short-term returns have limited significance. What matters is not making a single big leap but winning the marathon. Nevertheless, each successful investment decision contributes permanently to the fund’s performance – and demonstrates our ability to assess the cryptocurrency market more accurately than can be achieved with a passive strategy – such as a spot ETF.

Current positions of the F5 Crypto Fund

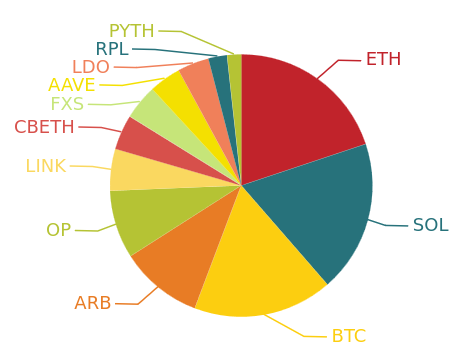

About two thrids of the portfolio are currently invested in the following discretionary positions:

The large caps BTC and ETH still play a significant role, comprising over 30% of the fund’s assets under managment.

SOL also continues its major influence: Unlike the F5 Crypto Index, which drastically reduced its exposure to SOL at the beginning of the month, we keep a strong active position. This is because Solana’s exceptional performance still holds potential – and unlike the index, the fund’s active management can make short-term adjustments at any time.

Furthermore, we have increased the weighting of our investment thesis on the Ethereum ecosystem: ARB and OP together represent almost 15%, while LDO and RPL constitute an additional 5% of the fund’s volume. We anticipate that these assets will offer the best risk-return ratio at the beginning of a new cycle.

One-third of the fund’s volume continues to be invested according to the index-based investment strategy based on the F5 Crypto Index, covering the corresponding 12 cryptocurrencies.

Aim and strategy behind this positioning

The F5 Crypto Fund invests in the entire liquid crypto market with its battle-tested, risk-optimised, and thesis-based approach.

Our active risk management monitors all positions as well as the overall market, so we can react swiftly to disruptions — as we have repeatedly demonstrated during the last bear market.

Nevertheless, our current outlook is strongly bullish: The fund has been fully invested for almost a year, and is now implementing our strategy for uptrend phases: overweighting selected mid-cap and small-cap assets. They exhibit a stronger return potential than the large-cap BTC and ETH behemoths, which served as valuable anchors during turbulent times.

This way, the F5 Crypto Fund has outperformed BTC year-to-date, as it did before. Its clear strategy, based on its long-term investment philosophy and implemented via the active management of long-only, hand-picked positions, provides full participation in the opportunities of the crypto market — especially due to smaller, newer, emerging crypto projects. Which is precisely where our expertise matters most.