Beyond Bitcoin: Build Back Beta

The F5 Crypto Fund has moved beyond Bitcoin: Its discretionary BTC target allocation now lies at 0%. The flagship crypto token, accounting for more than 50% of total crypto market capitalisation, despite its solid +45% year-to-date performance – divested?

Why we will do without BTC despite our strong positive view in the near future: our rationale.

The F5 Crypto Fund is an actively managed crypto fund which provides an institutional-grade investment opportunity into the entire asset class of crypto assets. For our investment committee, this implies an objective to first and foremost identify the most promising tokens to invest in – as well as to ensure that all coins not meeting our stringent criteria stay out.

- An example of the latter would be our refusal to take active positions in LUNA or FTT even at the times when they were very much en vogue, based on our research highlighting their fundamental instability resp. intransparency – and infamously both ultimately all but disappeared overnight.

- An example of the former are our purchases of Solana (SOL) at severely depressed 16.73€ and 20.29€ and keeping a strong position (currently our largest) until today’s 140€ price tag.

In short financial lingo, our objective #1 is identifying alpha in the still inefficient nascent asset class we provide secure access to.

Beyond alpha: What else matters?

However, this does not mean that our active management is restricted to only look for tokens with favourable risk-return tradeoffs. Our portfolio management additionally addresses the following key aspects of risk management:

- Diversification – what matters is the risk profile of the aggregate portfolio, not individual positions. 72 years after Markowitz published this fundamental insight most financial professionals do put the theory into practice in stock portfolios. Yet too many crypto investments still fail to fully capitalise on the opportunities of intra-crypto diversification. Are you tracking diversification measures of your aggregate crypto exposure? If not, yours will likely be among those.

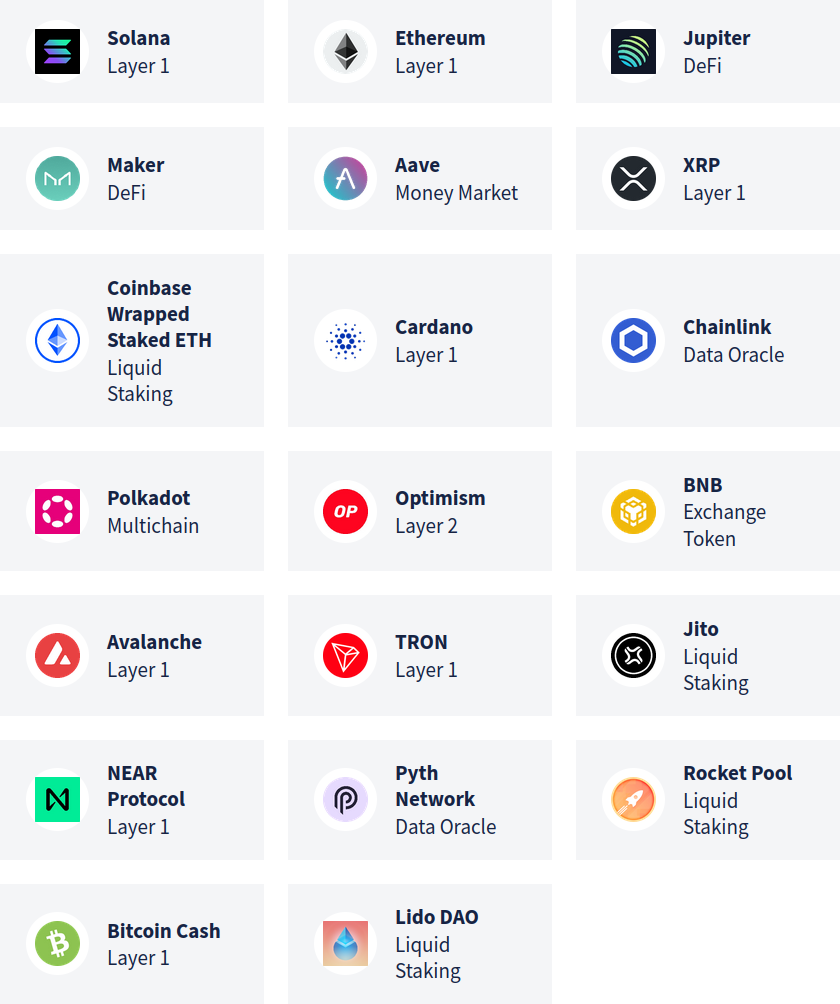

- Market coverage – the asset class of crypto is significantly broader than the top few coins which garner most attention, and an optimal portfolio makes use of those opportunities. The BTC and ETH ETFs are great if you want to invest in BTC or ETH: not if you want to invest “in crypto.” This is exactly the same as owning the top 2 or 3 shares emphatically differs from “investing in the stock market.”

- Cyclicality – just like the stock market (albeit more extremely), the crypto market exhibits long-run price predictability. Or irrational exuberance. Or time-varying risk premia. Which, to a very large degree, are all flip sides of the same coin, as the 2013 Nobel Prize exalted.

- And many more – drop me a message on LinkedIn if you wish a follow-up covering more details.

In short financial lingo, our objective #2 is portfolio optimisation, rather than independent coin picking.

Bitcoin: What matters now?

As far as BTC is concerned, the three main points currently showcase an exceptionally clear situation:

- Diversification – a well-diversified portfolio of 20 crypto assets simply does not require BTC as an indispensable contributor to diversify the portfolio risk.

- Market coverage – as our investment universe includes more than 200 liquid crypto tokens, spanning tests indicate that the singular BTC return series is no necessary ingredient to cover the asset class.

- Cyclicality – this is really the key point to understand our dynamic allocation strategy: Bitcoin, while highly volatile from a stock-market perspective, is – relatively speaking – really one of the most “stable” crypto assets (with the exception of functioning stablecoins and ailing projects long past their heyday, neither of which we invest in). At the same time, a sizable part of the risk of younger budding projects is systematic, i.e. correlated with the crypto market. Hence during a cycle’s uptrend these projects are most attractive.

In short financial lingo, our objective #3 is steering beta strategically – reduce systemic risk during downtrends by overweighing large-cap tokens and potentially temporarily moving into cash; and conversely, increase beta for periods with high expected returns.

No more Bitcoin, but more beta?

Does the zero target for BTC imply that we are bearish on Bitcoin? Very clearly and simply: No, not at all.

Quite to the contrary. As outlined, precisely because we have a positive view on the crypto market for the foreseeable future, and this necessarily includes the bellwether Bitcoin, do we increase our portfolio risk-taking.

Due to the impossibility of precisely timing highs or lows in real time, this is a gradual process. We set the target investment rate to 100% already in the first half of 2023. We announced our shift from large-cap to mid- and small-cap cryptos early this year. Now we have redeployed the capital from our BTC position, which has developed very well with +45% YTD despite the recent dip, to even more promising tokens.

So moving away from Bitcoin is no statement about Bitcoin, but reflects our positive view on the aggregate crypto market – and proof that our strategy is working as planned.

Outlook: A crypto fund without Bitcoin?

We are aware that this aspect of our strategy is not mainstream. However, we do not optimise similarity to others, or conformity with common expectations, or PR value: we optimise the crypto portfolio of our investors. We optimise the risk-return contribution of the asset class of crypto to their portfolio. And we do so based on our strong scientific approach, our fundamental analyses, and our long-term strategy.

So when we offer the F5 Crypto Fund as a one-stop-shop solution for investing in the crypto sector, we optimise both for alpha and beta. Plus adjust that dynamically over the crypto cycle.

Bitcoin will surely enter our portfolio again: it is only a matter of time until the most solid of all crypto assets will exhibit risk-return properties that lead to its inclusion. Bitcoin’s dominance of the crypto market anchors its beta.

But right now, we expect a price rally which will disproportionately profit the best mid- and small-cap tokens with higher betas. Hence increasing beta is exactly the reason why we have drawn down our discretionary target allocation of BTC to zero.